BVI FSC and VIDIC Embrace Co-Monitoring Role

The statutory framework of BVI Financial Services Commission's (the Commission) co-monitoring partner – the Virgin Islands Deposit Insurance Corporation (VIDIC), has now been solidified with the Cabinet’s approval of the appointment of its first Chief Executive Officer, Ms Lisa Ann Violet, on 26 June 2024. The mobilisation of the VIDIC Board and executive and administrative framework are key steps toward the enhancement of depositor confidence and financial stability in the Territory. Ms Violet, a chartered professional accountant and financial expert with over 25 years of experience in financial services, bank regulation, and enterprise risk management, will play a critical role in helping the VIDIC to achieve its mission.

BACKGROUND TO THE VIDIC

The Virgin Islands Deposit Insurance Act, 2016 (the Act) was passed in the House of Assembly on 19 April 2016, was amended and came into force on 7 March 2023.

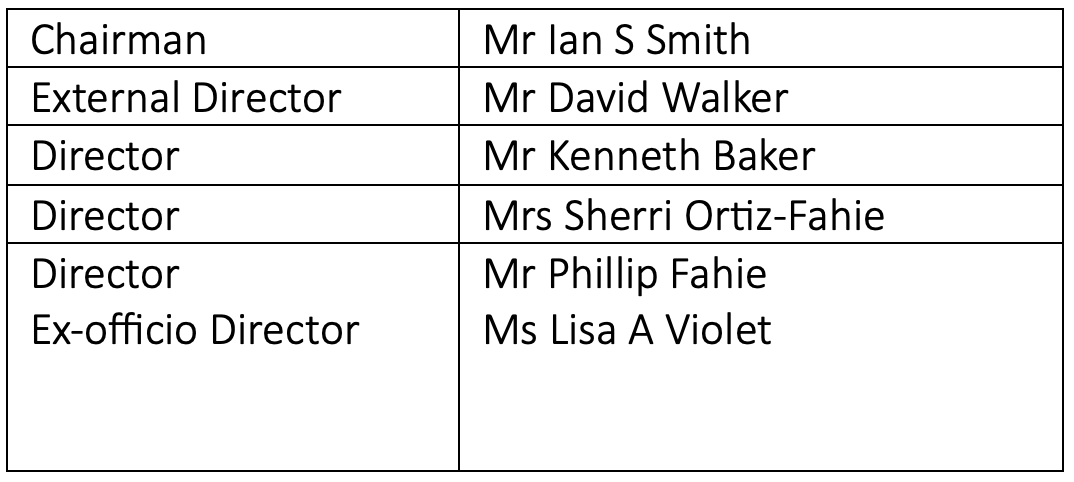

In a January 2024 Government Press Release, the establishment of the VIDIC was formally announced as a ‘crucial step toward[s] enhancing financial security for depositors within the Territory’, and the inaugural Board was announced. With the recent appointment of the Chief Executive Officer, the full Board complement comprises of:

The VIDIC is a body corporate as defined by the Interpretation Act, 1985, and as such, it can regulate its own procedures and business, sue and be sued in its corporate name, and exercise other related powers.

OBJECTIVE OF THE VIDIC

The VIDIC is established to protect the deposits of consumers and, like the Commission, the VIDIC is obligated to pursue actions that contribute to the stability of the Territory’s financial system. In seeking to perform its functions, the VIDIC must establish and manage systems for insurance of deposits, assess and mitigate against financial risk exposure, and pursue such other objects that will benefit persons who maintain deposits with member institutions.

THE RELATIONSHIP BETWEEN THE VIDIC AND THE COMMISSION

The Commission and VIDIC operate a dual co-monitoring function related to the banking system. The Financial Services Commission Act, 2001 (the FSC Act), in the case of the Commission, and the Act in the case of the VIDIC, provide the statutory parameters and the scope within which each institution must conduct its respective functions.

The Act identifies several instances where the VIDIC and FSC are required to work together, including the following:

- The VIDIC can make recommendations to the Commission for actions to be taken in respect of any member institution that appears to be in distress.

- The VIDIC may request and receive reports from the Commission made in connection to any member institution.

- The VIDIC must provide the Commission with information that it may use to enhance sound financial practice in the Territory.

- The VIDIC must liaise with the Commission before appointing a receiver, liquidator or judicial manager.

- VIDIC member institutions must submit to be inspected and examined by the Commission at least once every two years.

THE IMPORTANCE OF DEPOSIT INSURANCE

With the fund now in place, according to the Chairman of the VIDIC Mr Ian Smith, “provisions have been put in place to protect consumers from not just the impact of bank liquidity issues but also risks that may follow reputational damage. Bank financial distress created by crises in the banking system is notorious for manifesting in phenomena like run-on banks – a situation where depositors decide to withdraw their funds immediately, which could ultimately lead to liquidity issues. Where a bank shows signs of distress, the VIDIC’s concern is that depositors are protected and where necessary, the banking institution can be wound up in the most efficient way possible yet in such a way that has the least impact on financial stability; essentially, we are able to evaluate circumstances of potential bank failure, and where relevant, utilise bridge bank and resolution powers as a means of reducing negative impacts to the system.” Mr Smith added, “The VIDIC has already collected the first of two semi-annual premiums from each of the seven local deposit-taking banks. The annual premium is ‘20 basis point’ (i.e., 0.2%) of insurable deposits. The total has since been utilised by the VIDIC to create the Deposit Insurance Fund.”

The Managing Director and CEO of the Commission agreed with the VIDIC Chairman, stating that “it is vitally important to do what is necessary to preserve consumer confidence in the financial system. The Commission classifies banks as systemically important because of their impact on the real economy. The Commission will continue to ensure our banking sector remains vibrant and resilient, and the addition of a deposit insurance framework adds to this.”.

Mr Baker continued by noting that “the Commission and VIDIC have already started to forge a strong and mutually beneficial relationship, which is reflected in the significant work already accomplished between the two institutions”.

Ms Violet stated that it is an honour for her to serve as the CEO of VIDIC. She went on to further emphasise the critical role that the deposit insurance organisation will play in ensuring the stability and security of the financial system, and assured that joint efforts would soon be underway to launch a public awareness campaign about the VIDIC.

The BVI Financial Services Commission is the autonomous regulatory agency responsible for regulating and supervising financial services conducted in and from within the Territory of the Virgin Islands.

- Log in to post comments